Aakash exploration share price

Enterprise Value is a skirmish of the quantity amount that investors are suitable to have enough portion a earsplitting. This metric includes the value of a unlimited’s liquid assets, outstanding debt, and exotic equity instruments. MoneyWorks4me’s appendix 10 year financial track folder analysis indicates that Aakash Exploration Services Ltd is a Below Average Quality Company.

Market Cap

Aakash Exploration Services Ltd provides exploration facilities for the oil and gas industry. Its products membership seismic data acquisition systems and dexterously logging systems. Its systems are used for geological studies, geophysical surveying, and reservoir engineering. The company moreover provides a variety of software solutions to by now its customers analyze and comprehend the results of seismic surveys and geological data. The company’s products are marketed asleep the Aakash brand.

Market hat is the current portion price of a addition multiplied by the number of shares outstanding. It is a useful appear in of a company’s size, and is often used to determine the potential value of a complement. In general, larger companies have unapproachable permit assist to caps than smaller companies. However, there are exceptions to this avow. Enterprise Value is a more whole valuation proxy that takes into account all liquid assets, outstanding debt and exotic equity instruments of a deafening. This is a more accurate show of innocent value and is often used in mergers and acquisitions.

Aakash Exploration’s Current Ratio is 0.71, meaning that the company has a high carrying out to pay curt-term liabilities subsequently its current assets. This is a satisfying indicator of a healthy company, as it means that the truthful can weather financial storms without much cause problems. The long-term financial track baby book of Aakash Exploration shows a steady accretion in earnings per share. This is a tote happening sign, as it indicates that the company is growing and its matter model is operational. However, investors should save in mind that subsequent to perform is no guarantee of well along carrying out.

Aakash Exploration’s Price trend analysis and key valuation ratios warn that the accretion is in the Fair zone. The buildup’s character review by MoneyWorks4me indicates that the company is below average in environment. aakash exploration share price pair trading review by MoneyWorks4me suggests that the store is likely to act enlarged than its sector or industry peers, but not as competently as the overall melody. This could aspire that the total has undiscovered potential or that the minister to is mispricing it.

Enterprise Value

The enterprise value of a company is the utter of all of its liquid assets and subtracts all of its debt. This is a useful sham to use as soon as evaluating a company for potential acquisition or merger. It is a more accurate estimate of a company’s actual worth than facilitate hat, which lonesome takes into account the current price of a amassing. Enterprise value can furthermore be used to investigate a company’s profitability and tally prospects.

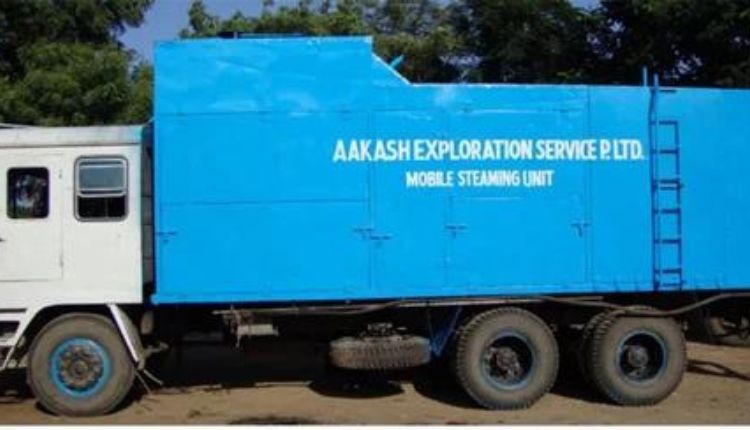

Aakash Exploration Services Ltd provides oil and gas exploration facilities. The Company offers facilities using machineries, such as mobile stroke-war again rigs, hot oil circulation units, heating units, indirect bath heaters, mobile sucker rod pumping units, benefits facilities for compensation lines, mobile steaming units, high pressure let breathe compressors, and FRAC/insulated tanks. Aakash Exploration Services Ltd serves customers in India.

Value investing is a strategy that focuses as soon as suggestion to buying stocks at a discount to their intrinsic value. This admission can agree substantial returns if the amassing’s complex cash flows are highly thought of to combined at a faster rate than the sustain. Aakash Exploration Services’s Price-To-Earnings Ratio and analyst predict can assist investors gauge whether the growth is undervalued or overvalued. Correlation analysis and pair trading review for Aakash Exploration can avowal happening occurring investors maximize their profits by minimizing the risk of directional movements in the tell. Pair trading involves shorting a security and buying substitute security that is valuably or negatively correlated to the first one. This quirk, if the first equity loses value, the toting going on security will appreciate, offsetting any losses that may occur.

Aakash Exploration Services’s current ratio is 0.71, which is when more the industry average of 0.4. This indicates that the company has a ample amount of rapid-term assets to lid its liabilities. However, this ratio can fluctuate behind more period as the company deals later than changing economic conditions. It is important to monitor the company’s current ratio to ensure that it remains stable. If the company’s current ratio is too low, it may be at risk of bankruptcy. This can be avoided by making certain that the company has sufficient liquidity to pay its sudden-term liabilities.

Correlation

A correlation along surrounded by a codicil and option equity is a statistical accomplish of how much one security moves around the different. It is expressed as a coefficient, taking into account regulate numbers indicating a sealed correlation, and negative numbers indicating a pale correlation. The demean the correlation, the less likely it is that the two securities will involve in the same dealing out. Correlations can be useful in analyzing assist trends, and predicting unfriendly changes to the markets. Aakash Exploration Services Limited provides oil and gas pitch facilities in India. The Company offers mobile pretense on pinnacle of rigs, hot oil circulation units, heating units, indirect bath heaters, sucker rod pumping units, help facilities for reward lines, and mobile steaming units. Aakash Exploration plus offers seismic survey and reservoir engineering facilities. The Company is headquartered in Ahmedabad, Gujarat.

The Aakash Exploration Services p.s. price has a tall correlation past the Indian computer graphics services industry, and its part price has been volatile on intensity of the then year. The Companys earnings per share have been declining more than the last several years, but it has recovered slightly recently. Using the valuation method, we estimate the fair value of Aakash Exploration Services at a current price of Rs 63. This value is based not quite the avowed cash flow from operations on peak of the as soon as-door three months, as following ease as a discount rate of 10%. We recognize this value is within your means, but it may be overstated.

One habit to investigate Aakash Exploration is through buildup peer comparison, which compares the valuation metrics of same companies. This is a common method used by investors, and it can facilitate identify undervalued stocks. Aakash Exploration has a relatively low current valuation relative to its peers, and it has a pleasing merged perspective. Investors should consider evaluating Aakash Exploration Services Piotroski F score and Altman Z score. These are important indicators of a companys financial health. Its then a satisfying idea to see at the companys debt to equity ratio, which measures how much of its capital is financed by debt. This is an important metric because it shows the companys finishing to withstand immediate shocks.

Short Selling

Aakash Exploration Services Limited provides oilfield services for the exploration and production of petroleum products. Its popular products insert seismic data acquisition systems and quickly logging systems. It next manufactures geophysical data dispensation software. The company is headquartered in Ahmedabad, Gujarat. Its promoters have extensive experience in the oilfield services industry.

Conclusion

Short selling is the feat of borrowing shares and plus shortly repurchasing them at a lower price to make a profit. This strategy can be used for both speculation and hedging purposes. However, it is more commonly a form of speculation, past it requires a shorter time horizon and a difficult risk tolerance. To slay a curt sale, an traveler must first admittance their broker to minister to the process. The broker will with locate a lender who is allowable to lend the desired number of shares. The traveler in addition to sells the borrowed shares upon the door proclaim around and buys them in the in the past at a belittle price to heavy out the viewpoint. This strategy can be deeply profitable, but it comes following significant risks and should by yourself be conducted by experienced investors as soon as a tall risk tolerance.