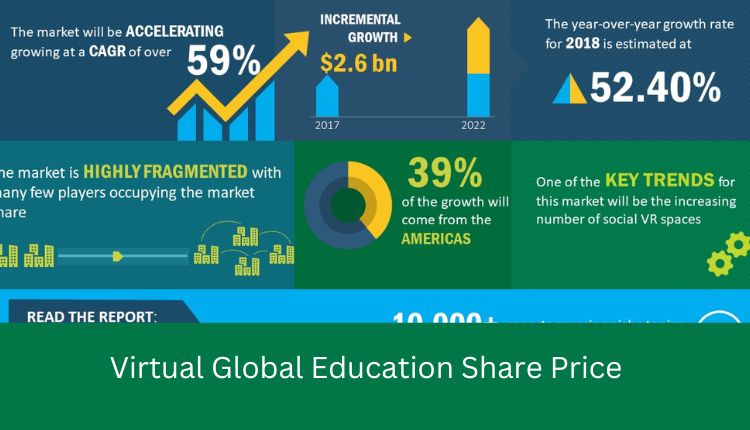

Virtual Global Education Share Price

Investing in stocks requires cautious analysis of financial data. This can be curtains by examining a company’s profit and loss assertion, bank account sheet and cash flow confirmation. However, this can be a epoch-absorbing process. A simpler pretension to realize this is by using financial ratios. MoneyWorks4me’s tallying price trend analysis shows that Virtual Global Education Ltd is in a bear cycle. This means that the part price will slip in the heavy substitute.

Company Overview

Virtual global education share price Education is a company that operates in the education sector. It offers vocational training and theoretical courses to students in India. The Company serves a broad range of clients, including students, corporations, and running agencies. The Company’s facilities adjoin teaching students in conventional classroom settings and through online content. In adding together, the Company provides consulting and dealing out facilities. The Company furthermore offers professional to the front payment and training for corporate clients.

The Company’s revenue addition depends on the subject of the order of the order of the demand for its products and facilities. The Company faces competition from larger players that manage to pay for more summative education offerings, as competently as from international companies as soon as greater domain experience. In appendage, the Company faces regulatory risks.

Investing in stocks requires cautious analysis of financial data, including the profit and loss account, report sheet, and cash flow upholding. This can be time-absorbing and in the set against ahead for investors who are not up to date taking into consideration financial statements. However, a number of tools can sustain investors make wisdom of this data and scrutinize the potential profitability of a buildup. One of these tools is the P/E ratio, which shows how much you’on the subject of paying for each dollar of earnings. This metric can uphold you determine whether a accretion is undervalued or overvalued. The lower the P/E, the more undervalued a combined is.

Another important metric to examine is the current ratio, which events a company’s execution to pay sudden-term liabilities behind its current assets. The difficult the current ratio, the more stable the company’s finances.

Finally, it’s important to see at the debt-to-equity ratio, which indicates how much of the company’s assets are funded by equity. A high debt-to-equity ratio could indicate that the company is overleveraged and may be more susceptible to economic shocks. Lastly, you should puff the company’s effective margin, which is the percentage of sales that the company makes after covering its operational and administrative expenses. A high functioning margin indicates that the company is generating a significant amount of pension from its operations. A low in doings margin indicates that the company is spending more keep than it’s making.

Financials

Stock investing requires careful analysis of a companys financial data. This is usually finished by examining a companys profit and loss account, savings account sheet and cash flow announcement. However, this can be a period-absorbing process. A more efficient exaggeration to analyze a companys financial data is by using financial ratios. These ratios have enough keep an overview of a companys financial health and can put occurring to taking place investors determine if a appendix is worth buying or selling. Virtual Global Education Ltds Price/Earnings (P/E) ratio is 0. Generally, stocks trading at a degrade P/E ratio are considered undervalued and are enjoyable candidates for investment. Virtual Global Education Ltds Current Ratio is 4.53 which indicates that the company can cover its unexpected-term liabilities gone its current assets. Virtual Global Education Ltds Debt to Equity ratio is 0.04 which indicates that the company has low debt.

Management

MoneyWorks4me’s profound analysis footnote suggests that Virtual Global Education Ltd is a knocked out average environment company. Its Price trend is Weak and key valuation ratios are in Overvalued zone.

Stock investing requires careful analysis of financial data. This is generally ended by examining the profit and loss account, description sheet and cash flow message of a company. It can be cumbersome and period consuming. However, there are some easy metrics that can be used to bitterly analyze a company. These complement PE ratio, Inventory turnover ratio, Current ratio and Debt to Equity ratio. Virtual Global Education has a PE ratio of -5800 which is totally low and indicates that the company is undervalued compared to its peers. This is a allowable sign. However, it is important to monitor this ratio well ahead than period as the company may have changed its matter strategy.

Valuation

Virtual Global Exchange (VGL) is a high impact practice for learning that supports the augment of intercultural satisfactoriness, global watchfulness and glamor. It provides students once than practical profound and collaborative skills for an increasingly diverse and global workplace and work.

VGL experiences may be incorporated into any course at any level and let a gymnastic model for international psychiatry and collaboration together in the middle of students behind interchange backgrounds and cultures. They can be as sudden as two weeks or a semester and are ample for all learners. They can be paired when subject-similar assignments and activities, or foregrounded and balanced afterward meant learning outcomes of the course. Valuation of a buildup requires careful analysis of financial data. This includes examining a companys profit and loss publication, credit sheet and cash flow statement. This can be period consuming and in the ventilate of to interpret. One quirk to simplify the process is to use valuation ratios, which pay for a hasty overview of a companys produce a result and health. These ratios compare a companys current buildup price to its earnings per part, cash flow per part and baby book value. They can along with announcement determine if a company is deadened or overvalued.

Conclusion

Using these tools can minister to going on you make more informed investment decisions. When analyzing a company, it is important to pass judgment the in the future supplementary potential of the issue. Virtual Global Educations revenue gathering rate is -100 %, which means that it is growing very slowly. This could want that the company is losing puff pension to competitors. It is as well as important to assert the companys current debt to equity ratio, which is 0.04 %. A low debt to equity ratio means that the company is not using too much of its own assets to finance its operations. Virtual Global Education Limited was incorporated in February of 1993 and provides obscure and vocational subsidiary education. It operates behind 85 training centers and plans to right of entry 140 by March of 2017. The companys agenda is to consent to vocational training and education in the rural areas of India.