Understanding Residual Income: Building Wealth Beyond Traditional Earnings

In today’s ever-evolving economy, many individuals are seeking ways to break free from the constraints of traditional employment and establish long-term financial stability. One concept that has gained significant attention in this pursuit is residual income. Often associated with financial independence and passive income streams, residual income offers a unique opportunity to generate wealth beyond the limitations of active employment. Do you know what is residual income? This article aims to explore the meaning of residual income, its benefits, and how individuals can leverage it to create a more secure and prosperous financial future.

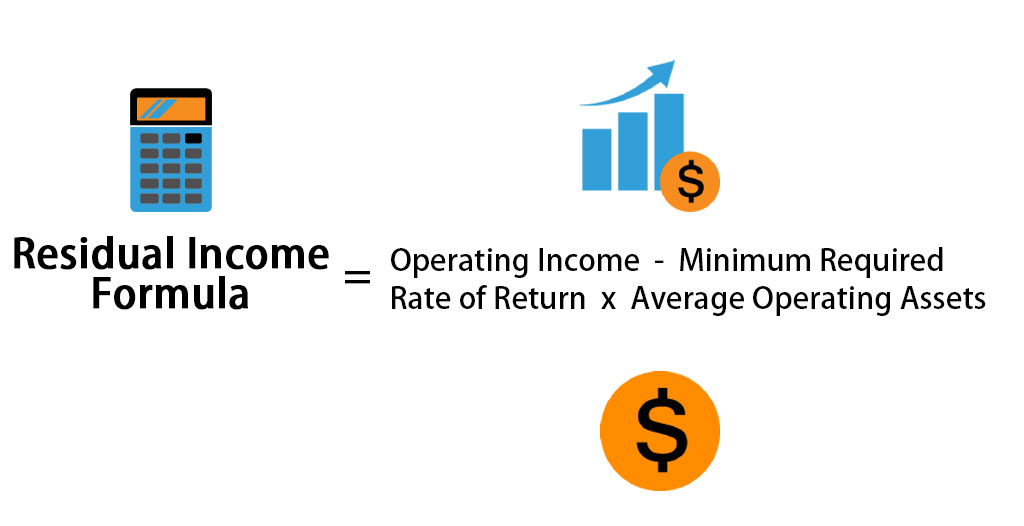

Defining Residual Income

Residual income, also known as passive income or recurring income, refers to the earnings that continue to be generated long after the initial effort has been expended. Unlike traditional employment, where income is directly proportional to the hours worked, residual income allows individuals to earn money repeatedly from an initial investment of time, money, or resources.

Sources of Residual Income

- Investments: Investments in stocks, real estate, mutual funds, or businesses can generate residual income in the form of dividends, rental income, capital gains, or profit shares. These assets continue to generate returns even when the investor is not actively involved.

- Intellectual Property: Creating and licensing intellectual property, such as books, music, software, or patents, can provide ongoing royalties or licensing fees. Once the initial creation is complete, the creator can earn income without continuous effort.

- Network Marketing: Joining reputable network marketing companies allows individuals to build a network of distributors or customers. As the network grows, individuals earn a percentage of the sales generated by their network, resulting in residual income.

- Online Businesses: Establishing online businesses, such as e-commerce stores, affiliate marketing websites, or digital product sales, can generate passive income through continuous sales and automated systems.

Benefits of Residual Income

- Financial Freedom: Residual income offers the potential for financial freedom by providing a steady stream of income that is not directly tied to active work. This freedom allows individuals to pursue their passions, spend more time with loved ones, and enjoy a higher quality of life.

- Wealth Accumulation: Residual income enables individuals to accumulate wealth over time. As the income streams continue to grow, one can reinvest the earnings, diversify investments, and build a solid financial foundation for future generations.

- Flexibility and Time Freedom: Unlike traditional employment, residual income often requires less time and effort once the initial setup is complete. This grants individuals the flexibility to choose when and how they work, affording more time for personal pursuits and experiences.

- Reduced Dependency on a Single Income Source: Relying solely on a single income source can be risky. Residual income provides a buffer against financial uncertainties by creating multiple income streams. Diversification helps mitigate the impact of any one source drying up.

Building Residual Income

Identify Opportunities: Research and explore various avenues that align with your skills, interests, and financial goals. Assess the potential income-generating opportunities and select the ones that resonate with you.

Invest Time and Resources: Building residual income requires initial investments, such as time, money, or effort. Be prepared to dedicate yourself to learning and implementing strategies to establish your chosen income streams.

Stay Consistent: Consistency is key to success in generating residual income. Regularly monitor and optimize your chosen income streams to ensure their long-term sustainability.

Expand and Diversify: As your income grows, consider expanding into other avenues to diversify your income streams. This helps protect against market fluctuations and maximizes your overall earning potential.

Conclusion

Residual income provides a pathway to financial independence and a more secure future. By leveraging assets, intellectual property, network marketing, or online businesses, individuals can create.