What Services Do Revenue Cycle Management Companies Provide?

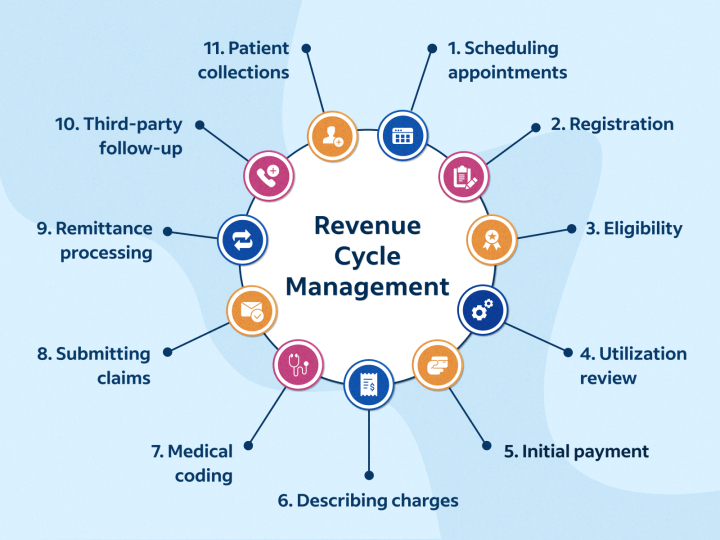

Revenue Cycle Management (RCM) is a vital component in the healthcare industry that deals with the financial aspects of patient care. It refers to the process of managing the financial transactions that occur during a patient’s entire cycle of care, from scheduling an appointment to the final payment of the bill. It is a complex process that involves different tasks, including coding, billing, collections, and insurance verification. Many healthcare providers choose to outsource RCM to third-party companies to manage these tasks and improve the efficiency of their revenue cycle. In this article, we will discuss the different services that RCM companies provide.

Patient Registration

The patient registration process is one of the most important steps in the revenue cycle. RCM companies ensure that this process is streamlined and accurate, which helps to avoid any billing errors or denials. They verify the patient’s demographics, insurance information, and eligibility, which helps to ensure that the insurance claims are processed correctly. RCM companies also maintain a database of patients, which can be accessed by healthcare providers to manage their patient records.

Insurance Verification

Insurance verification is a critical process in the revenue cycle management, as it ensures that healthcare providers are reimbursed for the services they provide. Atlantic RCM companies check the insurance eligibility of patients and verify the coverage details to ensure that the claims are processed correctly. They also keep track of changes in insurance plans, deductibles, and co-pays, which helps to avoid any surprises for the patients or the providers.

Coding and Billing

The coding and billing process involves translating the medical services provided into billable codes that are submitted to insurance companies for payment. RCM companies have certified coders who are proficient in the use of the latest coding standards, such as ICD-10, CPT, and HCPCS. They ensure that the codes used accurately reflect the services provided, which helps to avoid any denials or rejections of claims. RCM companies also submit the claims to the insurance companies on behalf of the healthcare providers and follow up on the claims until they are paid.

Accounts Receivable Management

Accounts Receivable (AR) management is the process of tracking and collecting payments from patients and insurance companies. RCM companies monitor the AR and follow up on any unpaid claims or outstanding balances. They also handle any appeals, disputes, or denials of claims, which helps to reduce the time and resources that healthcare providers spend on managing their revenue cycle.

Financial Reporting

RCM companies provide detailed financial reports to healthcare providers that help them to track their revenue cycle performance. These reports include key performance indicators, such as the average time to collect payments, denial rates, and revenue per visit. Healthcare providers can use this information to identify areas of improvement and make informed decisions that can optimize their revenue cycle.

Conclusion

Revenue Cycle Management is a complex and vital process that requires specialized expertise and resources. By outsourcing RCM to third-party companies, healthcare providers can focus on providing quality care to their patients while improving the efficiency of their revenue cycle. RCM companies provide a range of services, including patient registration, insurance verification, coding and billing, accounts receivable management, and financial reporting. These services help to ensure that healthcare providers are reimbursed for the services they provide, reduce the time and resources spent on managing the revenue cycle, and optimize the revenue cycle performance.