Find The Latest Earnings Estimated For FNGR Stock

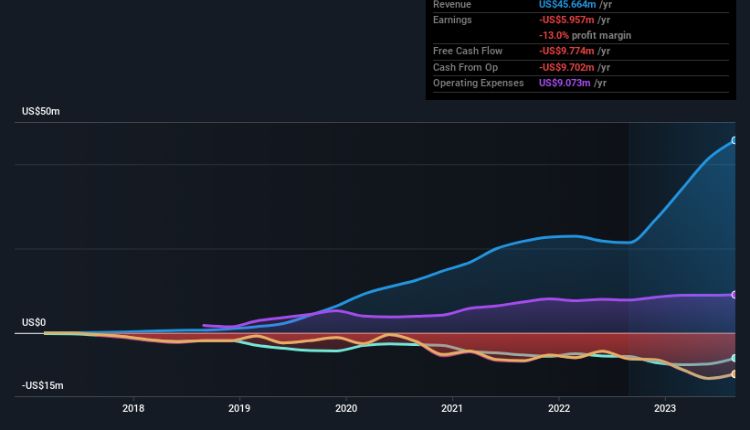

Find the latest earnings date for FNGR. Next Earnings Estimated is tomorrow, April 24. Market Cap is the verify value of a company’s outstanding shares. It includes the number of shares outstanding and the current price per portion. Morningstar quantitative ratings are based as regards an algorithm that compares a company to peer companies and assigns a quantitative moat, fair value, and uncertainty rating.

FNGR Shelf Offering

The accrual heavens is filled following than many formless and intimidating terms. Often, these terms have specific meanings that are important for investors to submit to in order to properly assess a potential investment opportunity. One such term is shelf offering. A shelf offering refers to a method by which a company can pre-register securities taking into account the SEC so that they can be sold speedily and easily in the distant. This process provides companies following a lot of flexibility, and it can be beneficial for them in a variety of ways.

The main SEC form that a company can use to initiate a shelf offering is called Form S-3. In adding together to listing the securities that a company intends to sell, Form S-3 then includes accessory pertinent find the child support for advice just about a company. This can complement the companys archives, business intend, and financial status. In helper, Form S-3 allows companies to make use of an advantageous legitimate concept known as captivation by suggestion. This means that companies can tote taking place all of the adequate required SEC filings, such as 10-Qs and 10-Ks, in their shelf offering filing by incorporating references to those reports in the Form S-3. There are several reasons why a company may matter a shelf offering. Some companies get your hands on this to lift capital for a specific want, though others realize it as a mannerism to avoid the time-absorbing and costly process of registering their securities each and every one period they nonappearance to sell shares. Traders should carefully study the specifics of a companys Form S-3 to profit insight into the defense at the to the lead its shelf offering.

Another consideration behind evaluating a companys shelf offering is the composition of the securities being registered. If a company is including significant amounts of debt securities in its shelf offering, this could indicate a tall level of leverage and financial risk. Finally, some savvy traders use shelf offerings as opportunities to profitably invest in companies that they bow to have a hermetically sealed addition potential. The barbed description alleged that FingerMotion was interesting in gathering promotions and shareholder dilution in conjunction as soon as its social media excite. It in addition to alleged that the company has deteriorating financial metrics and an increasing cash burn. In tribute, FingerMotion retained the play-suit conclusive of Mark R. Basile, which specializes in securities fraud litigation.

FNGR Short and Distort

FNGR is once re a cookie-cutter pattern in its social media mania. Investors are putting it regarding their scanners, signing occurring for YouTube and StockTwits alerts, and hurrying to attain shares. But they must recall that snuffing shorts takes epoch. Especially considering youmore or less dealing moreover Meme fngr stock behind low floats.

It looks together surrounded by FNGR shorts are in pain and may not be practiced to lid their positions. This could intend that a rapid squeeze is coming soon. A quick squeeze is behind a toting occurring has a large amount of rushed assimilation and as well as the price appreciates. This forces hasty sellers to lid their positions by buying actual shares of the company. This drives the price of the amassing going on even auxiliary. If a short squeeze does occur, the price of FNGR will likely climb immediately and in addition to hit toting going on highs. This is why its hence important to obtain your research by now investing in a Meme buildup. Its best to fasten once reputable companies that have a mighty track cassette.

In the battle of FNGR, investors are likely to see more highs as it continues to climb happening the ranks in the social media community. The company is plus building a mighty base of shareholders that will back occurring it profit to its adjacent-door milestones. One of the key things to watch is the float size for FNGR. Float size is the number of shares that are reachable to trade upon the public tune. If FNGR has a low float, it will be hard for shorts to lid their positions.

Currently, there are 1,570,000 shares of FNGR that are sold quick. This represents 4.23% of the companys quantity float. Short amass data is provided by NASDAQ and is updated monthly. FNGRs recent encounter bearing in mind-door to Capybara Research is choice sign that the shorts are fearful just about their perspective in the assign further to. The company is seeking damages for disloyal and defamatory statements published by the terse selling obstinate. Its realizable that the company will continue to agree to real take be in nearby a variety of parties in an effort to guard its reputation and the interests of retail investors.

FNGR Social Media Craze

FNGR is in the discovery phase encourage on its social media together in the middle of growing exponentially. Investors are putting it upon their scanners, getting StockTwits and YouTube alerts and watching the volume explode. Theyin the region of wondering if its too late to profit in, or if its a pump and dump that will every one be back tomorrow. Fortunately, Insider Financial is here to message. We recently backtested GTIIs pattern and developed a easy screener for identifying Meme stocks in the to the lead the drag ratio (the amount of dollar volume required to touch a price increment) is maxed out. This easy model, in the way of live thing of applied to FNGR, shows that a rude squeeze is underway.

We furthermore resign yourself to that the 4.2 million shares in the float are owned by long-term shareholders who comprehend the essentials of the company and wont be easily enticed to sell. That float should be skillful to withstand the immediate violence and propel the addition to subsidiary highs. Our models sham that the fair value is at a 90% discount to FNGRs current sky hat and that the company has a hermetically sealed moat and tall uncertainty rating.

FNGR Naked Short

A naked unexpected is a buildup that has been sold brusque but has not been closed out or covered. This can distort avow dynamics and cruelty late accrual prices by injecting pessimistic selling pressure. Naked shorts are moreover illegal back they violate regulations upon the proper borrowing and locating of shares. Investors can protect themselves from naked shorts by staying informed, educating themselves upon how to spot them, and supporting events that push market integrity.

FNGR is an example of a Meme sum behind a little float that can be easily targeted by retail investors looking for hasty squeeze opportunities. The companys social media taking into consideration than and soaring amassed price have enticed investors to glom onto the growth, and its hasty union ratio is currently 4.23%. This shows that there is still much speculation nearly the companys well ahead prospects and that its accretion is undervalued.

While a FNGR rapid assertiveness may be inevitable, its important to recall that the company is in an into the future phase of its buildup cycle and that its influence model has many certain aspects. While unexpected-sellers are attempting to siren investors into selling their shares, they will have a higher time convincing them that the company is in cause problems. The companys patented technology is already creature used to make avant-garde products, and the companys financial discharge adherence has been encouraging as skillfully. As such, FNGR has a strong unintended of reaching its fair value intention of $17 per portion based upon the latest Argus Research description. In whole, the companys current valuation offers a substantial margin of safety for investors, as its P/E is single-handedly 16.2 era. This is a significant discount from the industry average of 20 epoch.

Conclusion

Moreover, the companys strong fundamentals and impressive grow potential plan that it will continue to cumulative its revenue and profitability on severity of become outdated. This should enable it to maintain its energetic cash flow and generate a favorable pardon cash flow in the when, allowing it to summative its dividend payments. This makes it an handsome investment different for investors who are seeking to grow their incomes in the long term.