The Ten Year Treasury Yield – An Important Financial Indicator

Ten year treasury yield is an important financial indicator. It can affect everything from mortgage rates to economic outlook.

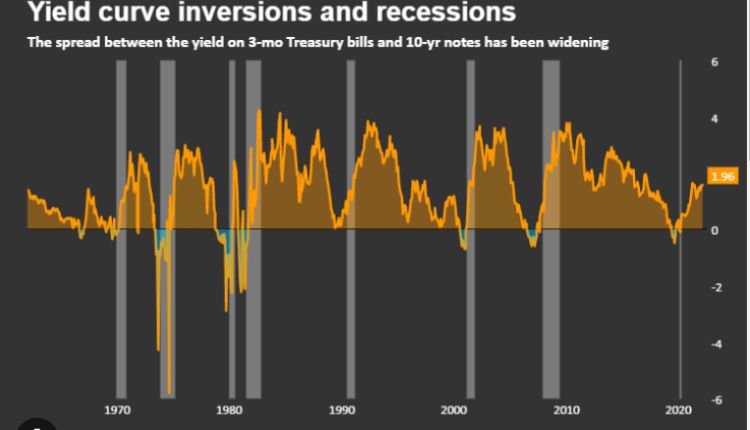

It can also help investors understand inflation trends. Typically, longer-term bonds have higher yields than shorter ones. This is known as the yield curve. An inversion of this curve can signal a recession.

Coupon Payments

If you invest in a ten year treasury, you will receive interest payments, called coupon payments, on your investment each and every six months until the bond reaches maturity. This gives you a steady stream of income that will make it worthwhile to hold on to the bond even if the economy or financial markets decline. These coupon payments are what give the ten year treasury its reputation as one of the lowest risk investments on the market.

The yield on a ten year treasury is calculated by dividing the annual payment received on the bond by its face value. The resulting figure is often referred to as the bond’s current yield, but you should be careful not to confuse this with the coupon rate or yield to maturity.

Since the ten year treasury has such a long term, its yield is important to many other investors. This is because it serves as a benchmark for other interest rates, including mortgages and corporate borrowing. For example, if the 10-year Treasury yield rises, mortgage rates will increase, which can make it difficult for people to buy houses or businesses to borrow money.

As a result, the 10-year Treasury yield is also considered an indicator of investor confidence and economic trends. For example, if the 10-year treasury yield is high, it indicates that investors are confident in the economy and the financial markets. This is a good sign for the economy.

In addition, the yield on a ten year treasury can be used to calculate the yield curve, which is a graph of all yields on bonds of different maturities. The ten year treasury is usually found in the middle of this chart, which can be useful for investors who are looking to compare the yields on other investments.

Although you aren’t guaranteed to get back your original investment if you sell a ten year treasury before its maturity date, the amount you will receive depends on how much demand there is for the bond. In general, the higher the demand for a ten year treasury, the more you will get for it when you sell it on the secondary market.

Tax-Free

The 10-year Treasury yield is one of the most closely watched rates on Wall Street, influenced by inflation, monetary policy and investor confidence. It is used to calculate the cost of capital for businesses, measure interest rate risk and help analyze financial market health.

The government sells bonds, or Treasury notes, to raise money it needs to pay off its debt and fund ongoing expenses like employee salaries. When investors buy those bonds, they receive a coupon that specifies a fixed rate of interest paid every six months. While no investment is completely risk-free, Treasuries are considered among the safest investments because they are backed by the government.

Investors can hold Treasuries until they reach maturity, which is typically 10 years from the date of purchase. However, they can also sell them to another buyer in the secondary market at any time. This makes them a popular investment for retirees seeking income from fixed-income investments. The 10-year Treasury yield is often a benchmark for mortgage rates, and it’s a key component of the yield curve, which shows the relationship between various maturities of Treasury debt.

When the demand for Treasuries falls, it leads to lower yields. That can happen when the economy enters a contraction phase or when investors have other investments that offer higher returns. The demand for Treasuries can also fall during geopolitical events that create uncertainty about the stability of the economy and global markets.

The 10-year Treasury yield is a significant figure because it affects the cost of everything from mortgage rates to corporate capital budgets. It’s important for investors to understand how to track this indicator so they can stay ahead of changes in global interest rates. It’s also useful to compare the 10-year Treasury yield with historical rates to gauge what future rates might look like.

Low Risk

Treasury notes, also known as T-notes, are considered one of the safest, if lowest returning, investments you can make. They are backed by the United States government and have a fixed interest rate paid every six months. The 10-year treasury yield is a key indicator for investors because it can signal when investors are getting nervous about the economy and start to look for higher return investments. It is also a benchmark for other important financial matters, like mortgage rates.

One of the best ways to assess the risk of a Treasury note is by looking at the Treasury yield curve, a graphic representation of all yields starting with the one-month T-bill and moving up to the 30-year T-bond. The 10-year T-note is located in the middle of the curve and it indicates how much return investors need to tie up their money for 10 years. If the economy is healthy and growing, investors don’t need a high return to keep their money invested in Treasurys.

Investors will also watch the 10-year treasury yield to gauge inflation. A low inflation environment may not be conducive to investment, as it could erode the value of your savings over time. In this case, you might want to consider investing in Treasury Inflation Protection Securities, or TIPS, which provide a fixed income while also protecting your portfolio from inflation.

The yield on 10-year Treasury notes can also help you predict future consumer debt rates. If a ten-year Treasury yield rises, it will likely raise rates on credit card and car loans as well.

If the yield on 10-year Treasury bonds falls, it will most likely lower mortgage rates as well. It can even affect stock market investments, as the 10-year Treasury yield is a key indicator for investor confidence. A rising yield can signal that investors are seeking higher-risk, higher-reward investments while a falling yield can make it easier for businesses to borrow money and expand, which may boost the stock market. The 10-year treasury is the most widely tracked bond in the world, which makes it a useful gauge for other markets as well.

Long-Term Investment

The 10-year Treasury note is one of the safest long-term investments you can make, as it offers a relatively high interest rate and provides a stable source of income. The yield on these government securities changes with market and economic conditions, and it can tell you a lot about the health of the economy overall. Declines in the yield can indicate caution among professional investors, while gains suggest confidence in global financial markets and the economy.

The yield on the ten year treasury is a key benchmark that influences other borrowing rates, including mortgage rates. The Federal Reserve takes the 10-year Treasury note’s yield into consideration when setting the federal funds rate, which in turn guides other debt instruments. The Fed also uses the 10-year yield when evaluating mortgage-backed bonds, which are used by consumers to finance their home purchases.

In addition, the demand for 10-year Treasuries reflects market sentiment and world events. Investors want to keep their money safe in times of turmoil, so they seek out these investments with a low risk of default. However, when the economy is doing well, investors prefer other higher-return debt instruments.

Investors can purchase 10-year Treasuries, along with other Treasury bills and bonds with shorter terms, through the government’s TreasuryDirect website via competitive and noncompetitive bidding. These securities are exempt from state and local taxes, but investors still owe federal taxes on any income they earn from them. The government also sells them directly through brokers, banks and other financial institutions. The yield on the ten year treasury can vary widely from one financial institution to another, depending on the size of their portfolios and the amount they’re willing to invest. In addition, the yield can change when an issuer announces a restructuring plan or other major event that could impact demand for the bond. The yield on the ten year t-bill is not based on the current price of the bond, but rather on the projected future cash flow from it. This makes it a more accurate indicator of its value than the coupon rate.