Shopify Stock: A Comprehensive Analysis Of The E-commerce Giant

Shopify is an e-commerce giant that has grown to become one of the largest players in the industry since its founding in 2006. Its cloud-based platform allows entrepreneurs to create and run online stores, and it offers a variety of services and features to help businesses succeed in the competitive world of e-commerce. Over the years, Shopify has become an investor favorite, with its stock price increasing significantly. This article will provide a comprehensive analysis of Shopify stock, looking at its history, financials, growth prospects, competition, and risks.

History of Shopify

Shopify was founded in 2006 by Tobias Lütke, Daniel Weinand, and Scott Lake. It started as an online snowboarding equipment store called Snowdevil, which the founders created after struggling to find an e-commerce platform that met their needs. They ended up developing their own platform, which they later realized had more potential than their original business idea. The trio decided to pivot and focus solely on developing the platform, which eventually became the Shopify we know today.

Shopify went public in 2015 and has since seen significant growth in its stock price. In 2020, amid the COVID-19 pandemic, Shopify’s stock price surged as more businesses shifted to online sales. The company’s market capitalization now stands at over $150 billion.

Financials

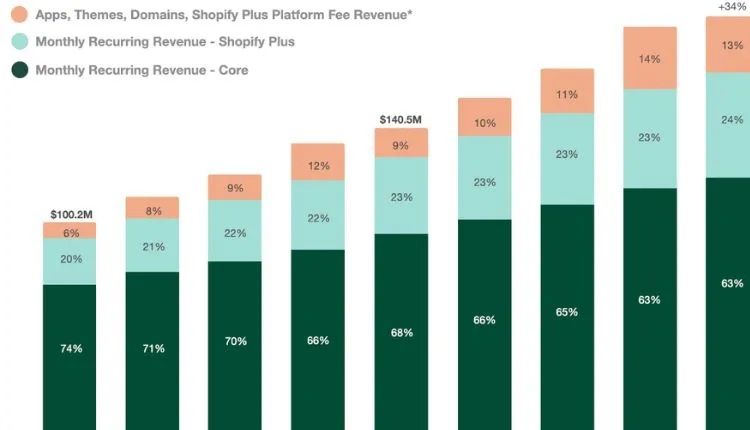

Shopify’s financials have been impressive, with the company experiencing rapid growth in revenue and gross merchandise volume (GMV) in recent years. In 2020, the company’s revenue increased by 86% to $2.93 billion, while its GMV grew by 96% to $119.6 billion. The company’s net income also improved, increasing from a loss of $124.8 million in 2019 to a profit of $319.5 million in 2020.

Despite this growth, Shopify has not been profitable every year since it went public. The company incurred losses in 2015, 2016, and 2017 before turning a profit in 2018. Shopify’s high growth potential, however, has continued to attract investors.

Growth Prospects

Shopify’s growth prospects are strong, with the company expected to continue expanding in the coming years. One of the key factors driving this growth is the increasing trend of consumers shopping online, a trend that has been accelerated by the COVID-19 pandemic. This shift towards e-commerce is expected to continue, with eMarketer forecasting that global e-commerce sales will reach $6.38 trillion by 2024, up from $3.53 trillion in 2019.

Shopify’s cloud-based platform, which offers a range of tools and services to help businesses succeed online, is also a significant factor in its growth potential. The company has continued to invest in the development of new features and services, such as its point-of-sale system, which allows businesses to sell in physical locations as well as online. Shopify has also been expanding its international presence, with the company recently launching in new markets such as Japan and Brazil.

Competition

Shopify operates in a highly competitive industry, with other e-commerce platforms such as Amazon, eBay, and WooCommerce all vying for market share. However, Shopify’s focus on empowering small businesses has given it a unique selling point that sets it apart from larger competitors.

Shopify’s competitors also face regulatory scrutiny, with antitrust concerns being raised about Amazon and other large players. This presents an opportunity for Shopify to position itself as a more ethical and transparent alternative.

Risks

While Shopify’s growth prospects are strong, there are risks associated with investing in the company. One of the main risks is increased competition, as other players in the industry continue to develop their own e-commerce platforms